I wanted to weigh in on this topic over spring break but I wasn’t sure how long the news cycle was going to last. There has certainly been confusion around the topic of tariffs but the piecemeal approach has made things uncertain. This has been reflected in the stock market since Liberation Day on April 2nd. In hindsight I'm glad I held off on opining on this topic because as it was happening more than one person became an overnight stock market expert.

I’m not directly disputing anyone’s knowledge, but I know that when a lot of people are talking about the market specifically, it doesn’t hurt to divert your attention elsewhere. Liberation Day was the day that President Donald Trump signed executive orders that would implement a 10% universal tariff. A tariff is a tax on imported goods. So, whatever you buy that is manufactured anywhere in the world other than in America now has an additional 10% tax levied on it and that’s the minimum.

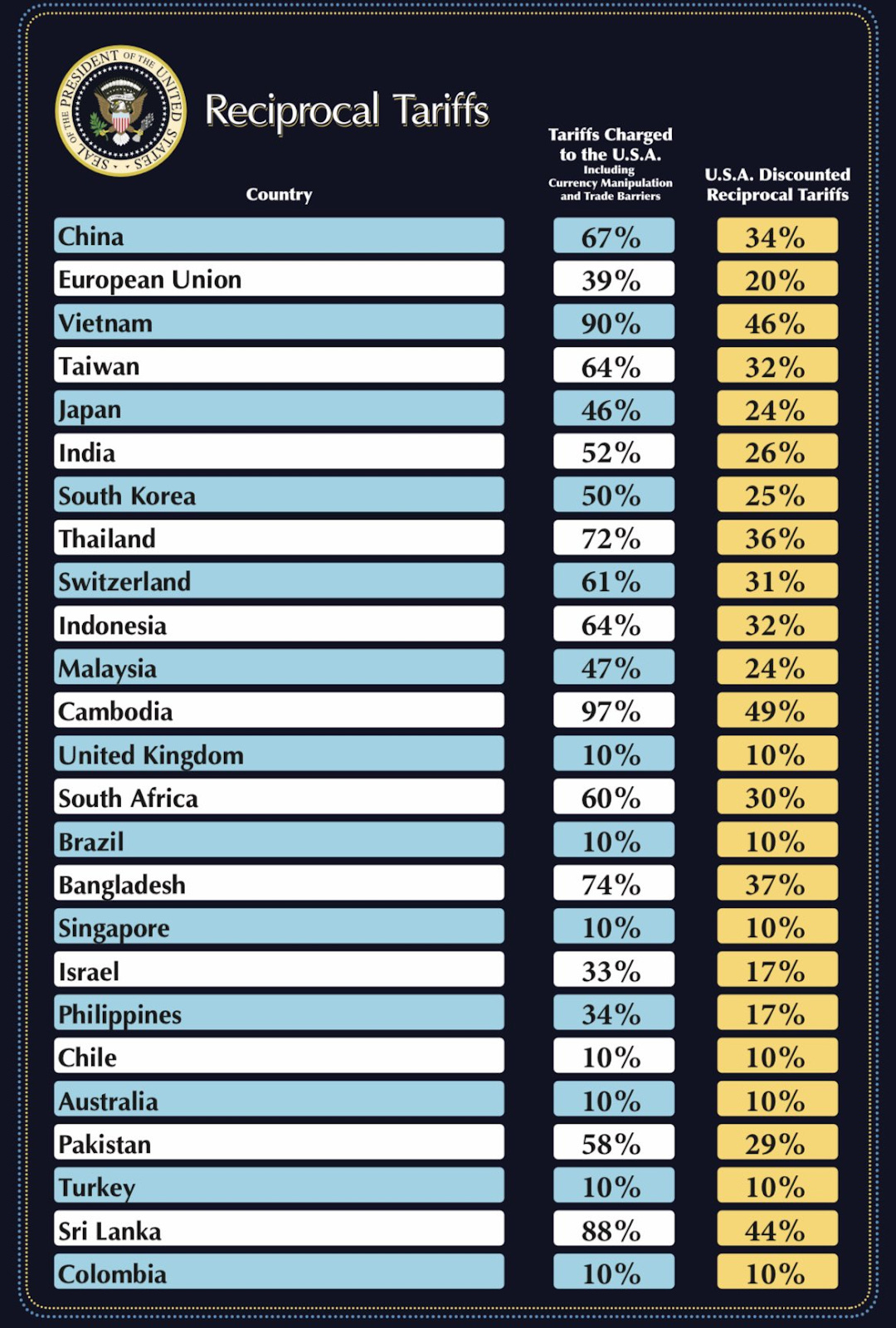

On Liberation Day not only did Trump announce a 10% universal tariff but he also unveiled country specific tariffs that he described to be generous. Some of those country specific tariffs include 34% on China, 41% on Syria, 24% on Japan, 26% on India, 20% on the European Union, and so on and so forth.

These are Trump’s reciprocal tariffs that he seeks to use to reduce America’s trade deficit and national debt. The Trump Administration is claiming that each respective country on the following list levies a particular tariff percentage on America and now America will be reciprocating those tariffs:

How the Trump Administration concluded how much each country is charging America in tariffs is unclear. That said, some people have figured out that Trump is likely coming to his tariff calculation by dividing the United States’ trade deficit with a country by our imports from that country. Thinkers on this subject don’t consider this calculation to be the most accurate because among other things, it only likely takes into account goods, materials, and physical products, but not services or other similar intangibles.

This is one part of Trump’s economic agenda another being the passing of the One Big Beautiful Bill, which has passed the House of Representatives and is currently in the Senate as of the publishing of this article. Additionally, Trump has been urging the Federal Reserve to further lower rates to encourage spending and in a way stimulate the economy. The goal is for more things to be made in America.

Manufacturing plain and simple means jobs. Other than jobs it also means independence and sovereignty in various respects. During the covid-19 pandemic America suffered from making little to nothing in our country and having to heavily rely on imported goods. Another thing manufacturing in America means in this case, is tax revenue. In theory with these tariffs the United States will get more tax revenue from imports and more tax revenue domestically, from more affordable, available, and incentivised American goods. This subsequently means more revenue from exports as well, because America will be making more products and will have more things to sell.

But, as mentioned in the beginning of this article one of the points of consternation has been a blanket tariff versus an itemized tariff. This has been the source of a good amount of the volatility in the market. Businesses are all but and in some cases are paralyzed. Depending on how someone runs their organization they don’t know if their products will be costly or discounted which creates all types of headwinds in an already tumultuous market, emphasized by Jerome Powell’s reluctance to lower rates more quickly.

There has also been noteworthy movement in U.S. Treasury Bonds where some of our biggest bond holders like Japan have been on a selling spree. Bonds are how a country finances its debt. The concern with a lot of bonds being sold off is that for the U.S. in this case to find other investors we resort to raising the interest rates on our bonds. This is different from the interest rate to borrow money. The higher our bond interest rate is essentially the more debt America puts itself in vis a vis having to pay interest on a loan. This can create tremendous economic uncertainty.

Since Liberation Day Trump has been orchestrating piecemeal deals with various countries. There are nearly 200 countries in the world and the United States probably trades with a plurality of them. Recently Trump announced a 50% tariff on steel imports, that’s a 50% increase from the original 25%. And don’t forget a 145% tariff on China was a thing. The best thing a business could probably do is consider building and buying American, especially if they want access to our market, which almost everyone does.

What I'm curious about and what we’ll have to see play out is what will happen down the line. Trump is a seminal negotiator, but what shape will this tariff policy take over time or by 2028? Is this just a Trump 2.0 thing? And if that’s the case can Trump usher in a golden age for American industry and wealth and if so, how soon? It’s difficult to find someone serious who isn’t for tariffs to some degree. But we’re all still waiting to know the full impact this moment may have. The last time America had a relatively strong tariff policy was the 18th and 19th century and that came with its fair share of challenges and ultimately didn’t last. Now isn’t then but history isn’t fully relegated to the past.

Keep reading with a 7-day free trial

Subscribe to Life with Ken to keep reading this post and get 7 days of free access to the full post archives.